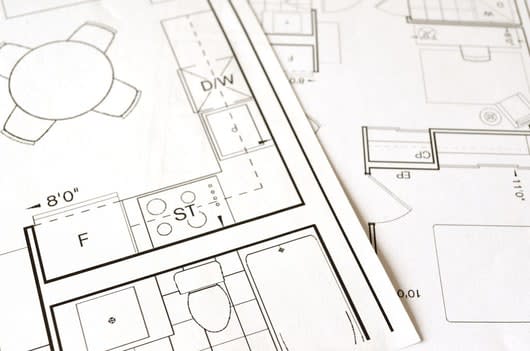

A Quantity Surveyor is a building industry professional who specialises in estimating the value of construction works.

ACP Quantity Surveyors

We offer you market leading, professionally prepared tax depreciation reports at competitive prices. Compare our prices.

As leaders in our field we have provided legitimate, ATO compliant deductions to thousands of residential and commercial property investors. In short, we will help you to manage your property in a cash positive way. We are committed to best practice and as Registered Tax Agents will ensure that you receive the maximum deduction allowed by the ATO.

-

![icon]() Reports last for

Reports last for

40 years -

![icon]() The best report in

The best report in

the industry -

![icon]() Trusted by

Trusted by

accountants -

![icon]() Money back

Money back

guarantee

1300550311Call Us Now Instant Quote 1300 550 311

Tax Depreciation

Quantity Surveyors

Over 35 Years In Tax Depreciation means we can Guarantee the Maximum Return – Everytime.

ACP Quantity Surveyors offer the smartest and most cost effective Tax Depreciation Service in Australia. Contact us now for savings on your Tax Depreciation Reports.

With recent legislative changes it now more than ever critical that you obtain professional advice from ACP Quantity Surveyors. If you have an older property it is still typically worth having a depreciation report prepared.

-

10,000Over 10,000

10,000Over 10,000

projects completed -

1,000Trusted by over 1,000

1,000Trusted by over 1,000

chartered accountants -

100%Money Back

100%Money Back

Guarantee

We are the Construction Cost

and Tax Depreciation Experts

We are professional quantity surveyors specialising in all

aspects of construction cost and tax depreciation from small to large projects

aspects of construction cost and tax depreciation from small to large projects

We offer you market leading, professionally prepared tax depreciation reports at competitive prices. Compare our prices. As leaders in our field we have provided legitimate, ATO compliant deductions to thousands of residential and commercial property investors. In short, we will help you to manage your property in a cash positive way. We are committed to best practice and as Registered Tax Agents will ensure that you receive the maximum deduction allowed by the ATO.

Real Results for Real People

In order to demonstrate the deductions that we have achieved for our past clients we have included case studies based on a number of real projects.

With recent legislative changes it now more than ever critical that you obtain

professional advice from ACP Quantity Surveyors.

professional advice from ACP Quantity Surveyors.

Our Professional Commitment to You

While providing a high end, professional, cost effective report is important to us, so is the experience that you have when engaging our company. If at any stage of the process you have a question or would like further clarification we ask that you discuss this with either our helpful staff or our Director.

1

Obtain a Quote

2

Application

3

Assessment

4

Approval